Introduction

The foreign exchange (FX) market offers a world of opportunity for traders

looking to profit from currency movements. Success in the FX market

depends not only on your knowledge and strategy but also on choosing the

right positions to trade. In this article, we will explore some of the best

positions to consider when trading in the FX market.

Major Currency Pairs

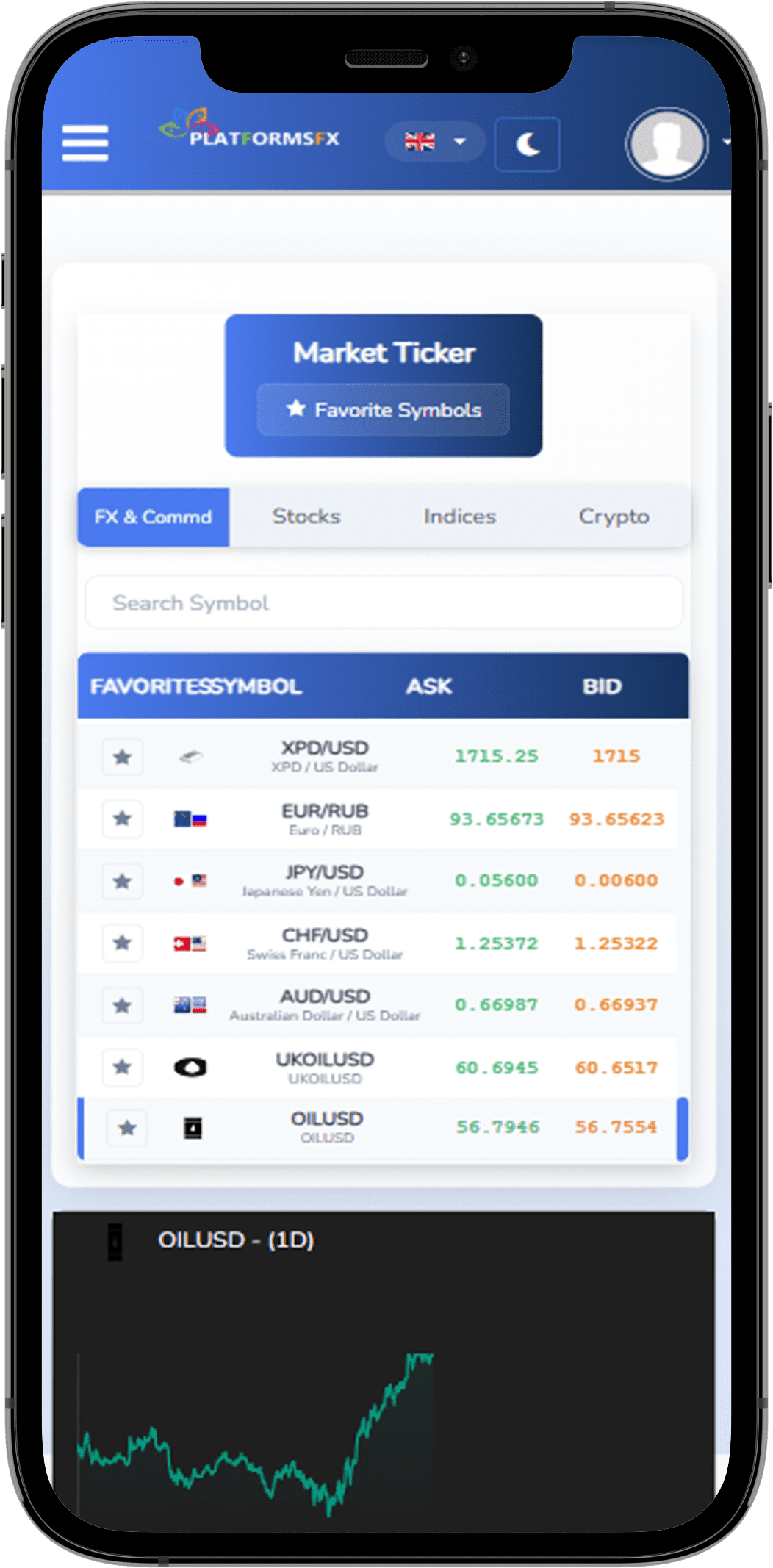

Major currency pairs are the most traded in the FX market and are often

considered a great place to start for new traders. These pairs involve the

world’s most powerful and widely used currencies, including the US Dollar

(USD), Euro (EUR), Japanese Yen (JPY), and British Pound (GBP). Examples of

major currency pairs include EUR/USD, USD/JPY, and GBP/USD. The high

liquidity and abundant information available for these pairs make them

ideal for both beginner and experienced traders.

Economic Powerhouses

Trading currencies from countries with strong and stable economies can be

a wise choice. The economic stability and resilience of countries like the

United States, Japan, Germany, and the United Kingdom can offer a sense of

security to traders. These currencies tend to be less volatile, making them

suitable for risk-averse traders.

Safe-Haven Currencies

Safe-haven currencies are those that tend to strengthen during times of

market turmoil or uncertainty. The US Dollar (USD), Swiss Franc (CHF), and

Japanese Yen (JPY) are considered safe-haven currencies. Traders often turn

to these currencies as a hedge against market volatility or economic crises.

Trading safe-haven currencies can provide a degree of stability in uncertain

times.

Exotic Currency Pairs

Exotic currency pairs involve one major currency and one from a smaller or

emerging market. Examples include USD/TRY (US Dollar/Turkish Lira) or

EUR/TRY. While exotic pairs can offer significant opportunities for profit due

to their volatility, they can also carry higher risks. These pairs are best suited

for experienced traders who understand the intricacies of the associated

economies.

Trend Trading

Trend trading involves identifying and trading in the direction of an

established market trend. Traders look for pairs that are showing a clear and

sustained trend in one direction, either upward (bullish) or downward

(bearish). Trend trading is a popular approach, and it can be applied to a

wide range of currency pairs. It’s essential to use technical analysis tools to

identify trends accurately.

Range Trading

Range trading is a strategy that focuses on currency pairs that are trading

within a defined range. Traders look for key support and resistance levels,

then buy when the price approaches support and sell when it reaches

resistance. This strategy can be effective in sideways or consolidating

markets, where currencies lack a clear trend.

News Trading

News trading involves reacting to economic events and data releases that

can influence currency prices. Traders focus on pairs associated with the

countries releasing significant economic data or events. For example, if the

US releases employment data, traders may focus on USD pairs. However,

news trading requires careful planning and fast execution, as currency

prices can react rapidly to news.

Conclusion

Selecting the best positions to trade in the FX market is a crucial decision

that can significantly impact your trading success. Your choice should align

with your trading strategy, risk tolerance, and level of experience. Major

currency pairs offer liquidity and stability, while exotic pairs can provide

high volatility and potential for profit. Safe-haven currencies offer

protection in uncertain times, while trend, range, and news trading

strategies provide various opportunities for traders to explore. Remember

that the best positions to trade are the ones that match your trading style

and objectives, and always conduct thorough research and risk

management before entering the FX market.