In recent years, traders have incurred significant losses due to fraudulent trading companies, amounting to approximately $20 billion annually. This staggering figure highlights the importance of verifying the credibility of brokers before engaging in trading. Choosing the right broker is a critical factor in enhancing the trading experience and safeguarding your capital. In this article, we provide a comprehensive guide to selecting a reliable trading broker, focusing on top-tier licenses and investor protection mechanisms.

Key Steps to Choosing the Right Broker

1. Determine Your Needs as a Trader

Before searching for a broker, it is essential to define your trading goals and requirements. This step involves:

• Available Trading Capital:

Select a broker that allows account openings with an initial deposit that suits your budget. Some brokers have high minimum deposit requirements, such as $1,000, while others offer options starting as low as $10, such as Investingor.

• Available Financial Instruments:

Brokers vary in the types of assets they provide. These include:

• Forex and cryptocurrencies: The most popular trading assets.

• Futures and options: For traders using advanced strategies.

• Commodities like gold and oil.

• Bonds: Offering fixed returns.

2. Evaluate the Broker’s Terms

After identifying your needs, assess the broker’s terms and conditions, including:

• Licensing and Regulation:

Opt for brokers regulated by reputable authorities, such as the Financial Conduct Authority (FCA) in the UK. Ensure these licenses cover your region. Brokers with multiple licenses often indicate greater reliability.

• Funds Security Measures:

Verify that the broker offers safeguards for traders’ funds, such as segregated accounts or participation in compensation schemes that protect clients in case of bankruptcy.

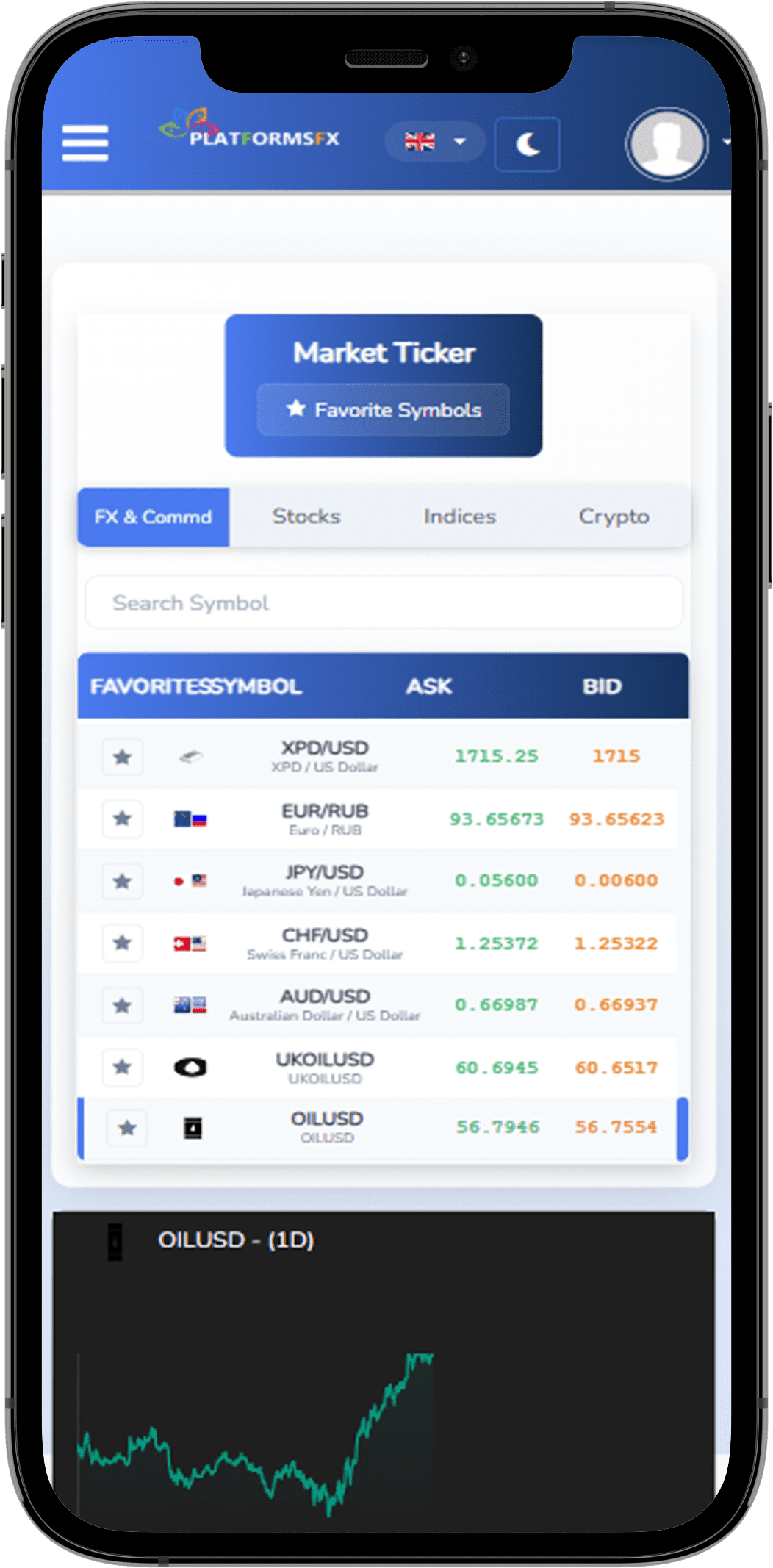

• Trading Platform:

Choose a broker with a user-friendly platform that supports your strategies and provides advanced analytical tools like PFX . Compare platforms based on cost, features, and ease of use.

• Trading Costs:

Review the fees for commissions, withdrawals, deposits, and leverage. Some brokers offer zero-commission services, while others may impose additional charges.

3. Test the Broker Before Committing

It’s crucial to test the broker before investing your funds by opening a demo account. This allows you to evaluate the platform and available services without risking real money. If you decide to trade with real funds, start with small amounts you can afford to lose.

Top Licensed and Trusted Brokers

According to experts, Investingor is one of the best trading companies, with a satisfaction rate of 88%. It offers global licenses, exceptional customer service, advanced trading tools, and a wide range of financial instruments, making it an excellent choice for traders.

Islamic Forex Accounts

For traders who prefer trading in compliance with Islamic principles, look for brokers that provide accounts free from interest charges. Many licensed brokers, such as Investingor, offer Islamic accounts that adhere to these standards.

Dealing with Fraudulent Companies

How to Identify Fraudulent Brokers:

• Lack of regulatory licenses.

• Unrealistic promises of high profits without risks.

• Imposing large fees or refusing withdrawal requests.

• Failing to provide transparent information about their services.

Reporting Fraudulent Activity:

If you fall victim to a scam, you can file a complaint through the Dhaman platform. This service collaborates with international regulatory authorities and governments to take legal action against fraudulent companies.

Conclusion

Choosing the right broker requires thorough research and ensuring compliance with regulatory requirements, platform reliability, and fund protection measures. A trusted broker increases your chances of success in trading, while engaging with unlicensed companies can lead to severe losses. Follow the tips above to ensure a secure and successful trading experience.