Discover what it takes to become a successful financial broker in 2025. From digital infrastructure to global trends and strategic partnerships, this expert guide reveals it all.

Introduction: Why Now Is the Time to Succeed in Brokerage

In an increasingly digitized global economy, the financial brokerage industry is no longer reserved for major banks or large institutions. With the right tools, vision, and strategic partnerships, becoming a professional financial broker is now more accessible—and more rewarding—than ever.

However what makes a successful broker stand out in 2025? The answer lies in mastering a combination of technology, regulation, client trust, and market knowledge. This guide walks you through the key attributes, infrastructure needs, and tools required to build a thriving brokerage firm in today’s global trading ecosystem.

1. Strong Technological Foundation

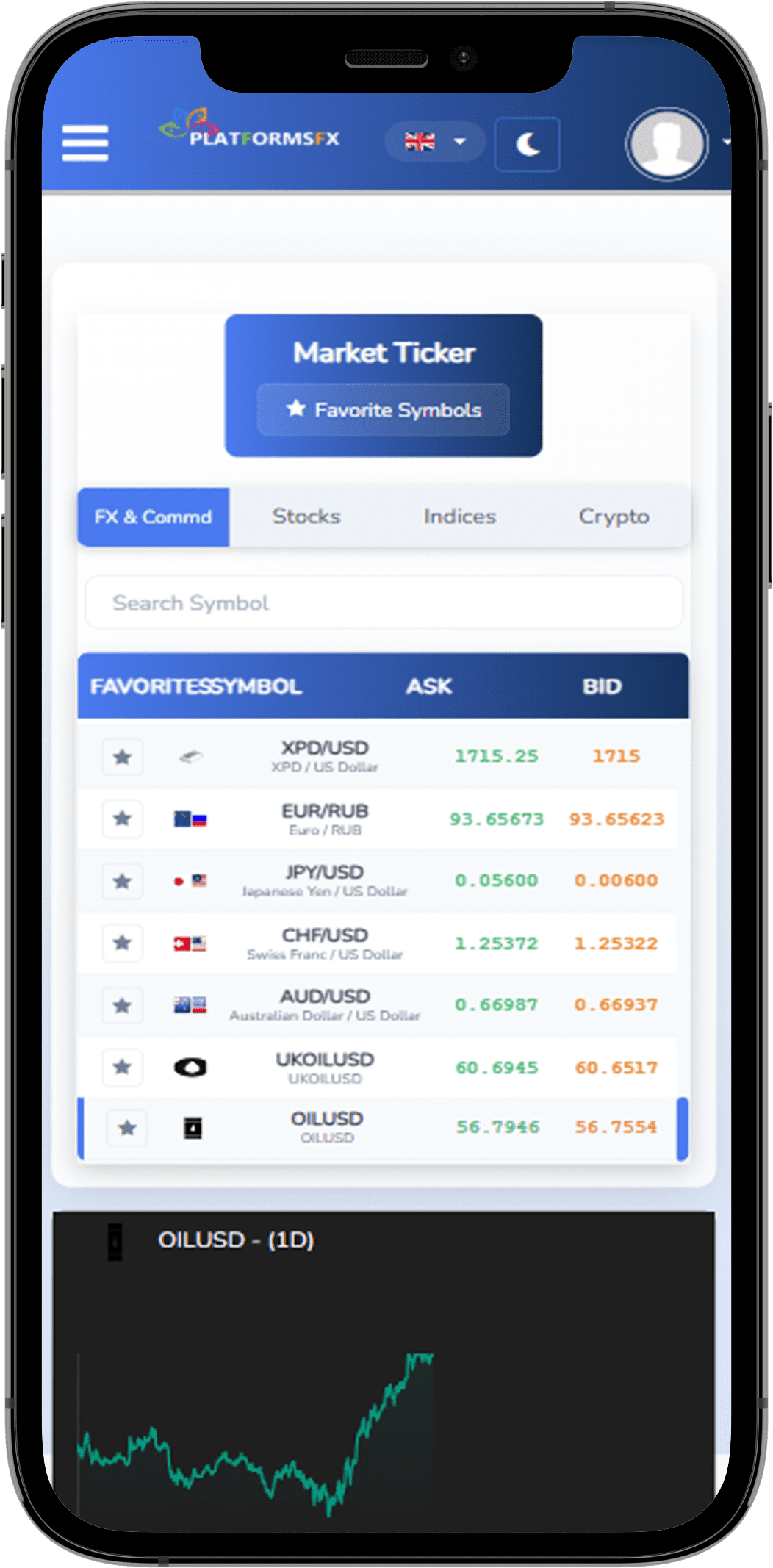

A high-performing successful financial broker is only as good as the technology behind it. In addition Your trading platform must be fast, reliable, and intuitive—not only for institutional clients but also for the growing number of retail traders.

Smart brokers today partner with specialized technology providers such as PlatformsFX, to access tailored platforms, liquidity connections, CRM integrations, and data security solutions. These partnerships enable seamless trade execution, real-time analytics, and full customization of the user experience.

💡 Tip: PlatformsFX for a provider with experience in global financial technologies, deep infrastructure, and a proven record of helping new brokers scale quickly.

2. Branding and Online Presence

In today’s competitive market, your brand is your identity—and in 2025, first impressions are made online. A compelling, modern brand with a clear message can make the difference between attracting serious investors or being overlooked.

Successful brokers invest in:

- Professional, responsive websites that load fast and support multiple languages

- Clear value propositions that differentiate them in a crowded market

- Strong social media presence across platforms like LinkedIn, Twitter, and YouTube

- SEO-rich content such as blogs, webinars, and trading tips to build authority

Your online presence isn’t just for show—it’s a critical trust factor. Clients will research your firm before registering, so make sure what they see reflects confidence, credibility, and consistency.

3. Client-Centric Experience

In 2025, clients expect more than just a platform—they expect personalized service, educational resources, multilingual support, and frictionless onboarding. Building loyalty begins with understanding trader behavior and optimizing the entire client journey.

From automated onboarding flows to 24/7 multilingual support, brokers that stand out are those who treat every interaction as an opportunity to build trust.

4. Data-Driven Decisions and Risk Management

Risk is part of the game in trading—but it’s how you manage it that defines your long-term success. For example A modern brokerage firm relies heavily on analytics dashboards, real-time risk monitoring, and predictive algorithms to safeguard both the business and its clients.

By leveraging advanced reporting and insights tools (often built into third-party platforms), brokers can optimize spreads, improve execution times, and protect margins during market volatility.

5. Strategic Technology Partnerships

Behind every agile brokerage is a reliable technology enabler—one that provides scalable infrastructure, ongoing support, and future-ready tools. Whether it’s a white-label trading platform, CRM system, liquidity aggregator, or payment gateway integration, choosing the right partner sets the foundation for your firm’s growth.

An example of such a provider—without overwhelming mention—is a company that specializes in end-to-end brokerage tech solutions, empowering both startups and established firms across the globe. These experts ensure that even non-technical founders can launch fully equipped, compliant, and competitive brokerages.

6. Market Differentiation and Positioning

To stand out in a crowded market, you need a clear value proposition. Whether it’s ultra-low spreads, innovative asset offerings (crypto, ETFs, indices), or exceptional mobile trading experiences, clarity and consistency in your brand’s message is crucial.

Build a marketing strategy that includes:

- A professional, multi-language website

- SEO-optimized content (blogs, guides, videos)

- Social media visibility

- Strategic partnerships in fintech ecosystems

7. Global Mindset with Local Sensitivity

Financial brokerage is a global game, However success often lies in understanding local nuances—regulatory restrictions, payment preferences, language, and cultural expectations.

The most successful brokers in 2025 are those who scale internationally while adapting locally. And this is made easier with access to modular, customizable tech solutions offered by experienced providers.

Conclusion: The Modern Broker Is Tech-Driven and Client-Focused

Becoming a successful financial broker in 2025 requires more than ambition—it demands a strategic roadmap, dependable infrastructure, and the right support ecosystem. By aligning with trusted technology enablers, maintaining strong compliance, and focusing on client experience, your brokerage can rise above the noise. Whether you’re just starting out or scaling an existing operation, the right technology partner will give you the flexibility, control, and innovation needed to lead in today’s ever-evolving trading landscape.