The S&P 500 index continues to attract increasing attention from investors worldwide as one of the most significant economic indicators reflecting the performance of U.S. markets. Representing approximately 80% of the total market value of U.S. stocks, the index includes the shares of 500 major companies across various sectors.

Investing in the S&P 500 is considered an ideal choice for diversifying their portfolios and achieving stable long-term returns. There are several ways to invest in the index, most notably through exchange-traded funds (ETFs) such as the SPDR S&P 500 ETF (SPY) and mutual funds designed to replicate the index’s performance.

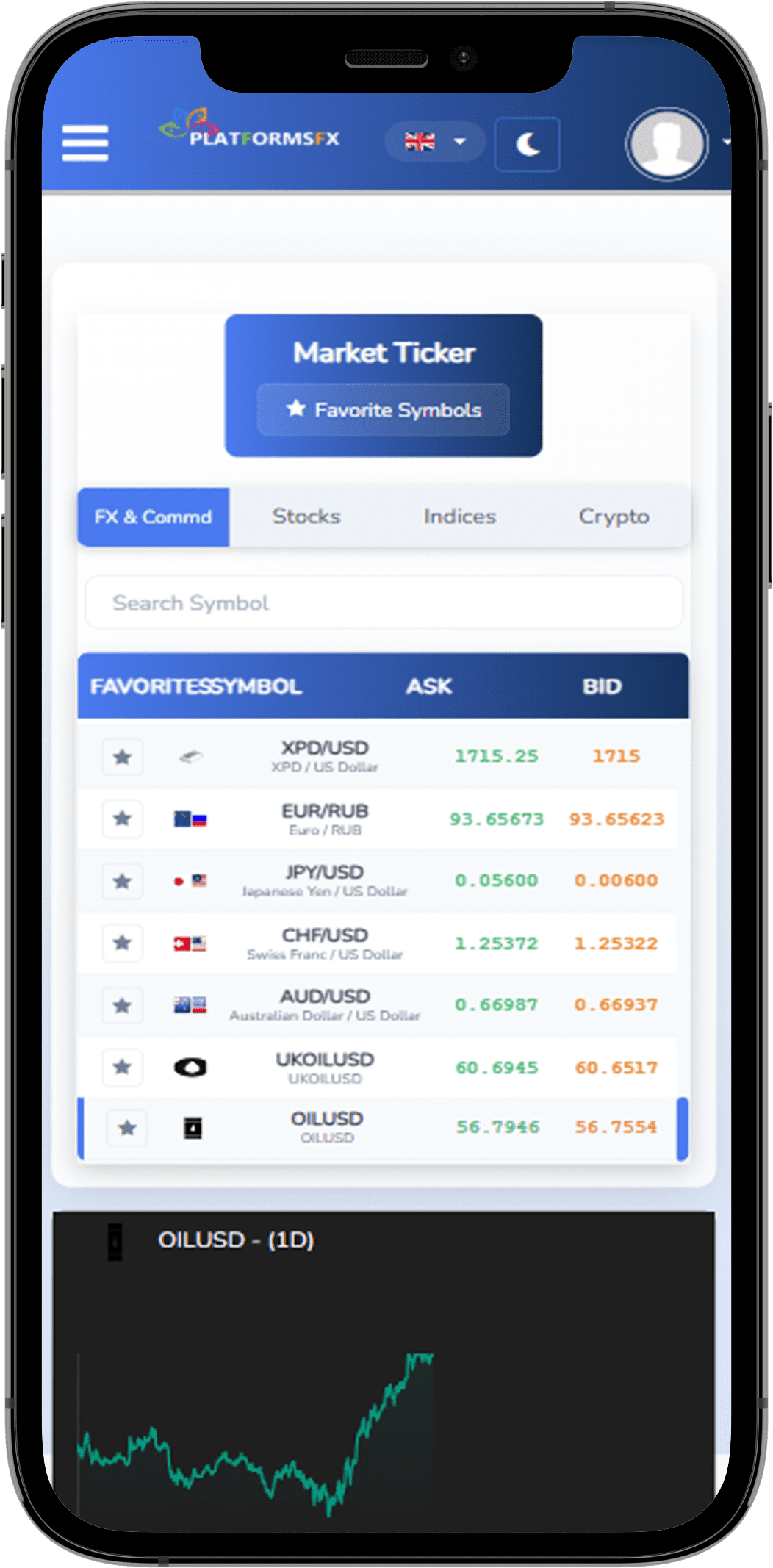

Contracts for difference (CFDs) allow investors to trade on the index’s movements without owning the underlying stocks. Online platforms and brokers also provide greater flexibility for direct investment in the index’s constituent companies.

Market experts anticipate that the S&P 500 will continue to draw investors due to its robust performance, despite short-term market volatility. They advise focusing on long-term strategies and diversifying assets within a portfolio to maximize the benefits of this pivotal index.