Safe trading platforms play a pivotal role in enhancing the success of financial brokers, especially in a market where competition among financial firms is intensifying. With the advancement of technology and the increasing reliance of investors on digital tools, a secure and reliable platform has become a crucial factor in attracting clients and maintaining the broker’s reputation.

1. Protecting Clients’ Funds and Data

A secure trading platform protects clients’ funds and their personal and financial information. Brokers who invest in building a platform that ensures data protection and transaction encryption provide clients with confidence in the safety of their assets. Maintaining the security of clients’ funds against cyber breaches is essential, as any breach can lead to a loss of client trust and a decline in the broker’s market reputation.

2. Building Client Trust and a Strong Foundation

Trust is a fundamental element of success for any financial broker. Clients seek a platform they can rely on to operate safely, free from concerns about fraud or breaches. A secure trading platform offers a smooth and trouble-free user experience, which helps attract clients and increase their loyalty to the broker. A solid client base, in turn, provides steady financial flows and long-term success for the broker.

3. Standing Out Among Competitors in a Crowded Market

In a highly competitive market, a secure platform serves as an effective tool to distinguish a broker from competitors. Financial firms that offer safe and reliable trading platforms enjoy a stronger competitive edge, as they attract more clients who prefer to invest in a secure environment. Therefore, brokers can leverage the security of their platforms as a promotional element to attract clients, enabling them to outperform their market rivals.

4. Compliance with Laws and Regulations

Regulatory bodies in many countries enforce strict laws concerning the security of trading platforms and the protection of user data. Adhering to these laws is not only a legal necessity but also helps build the broker’s credibility. Brokers who rely on secure platforms avoid legal and financial issues that may arise from legal violations, which strengthens their stability and long-term growth.

5. Providing an Efficient and Fast Trading Experience

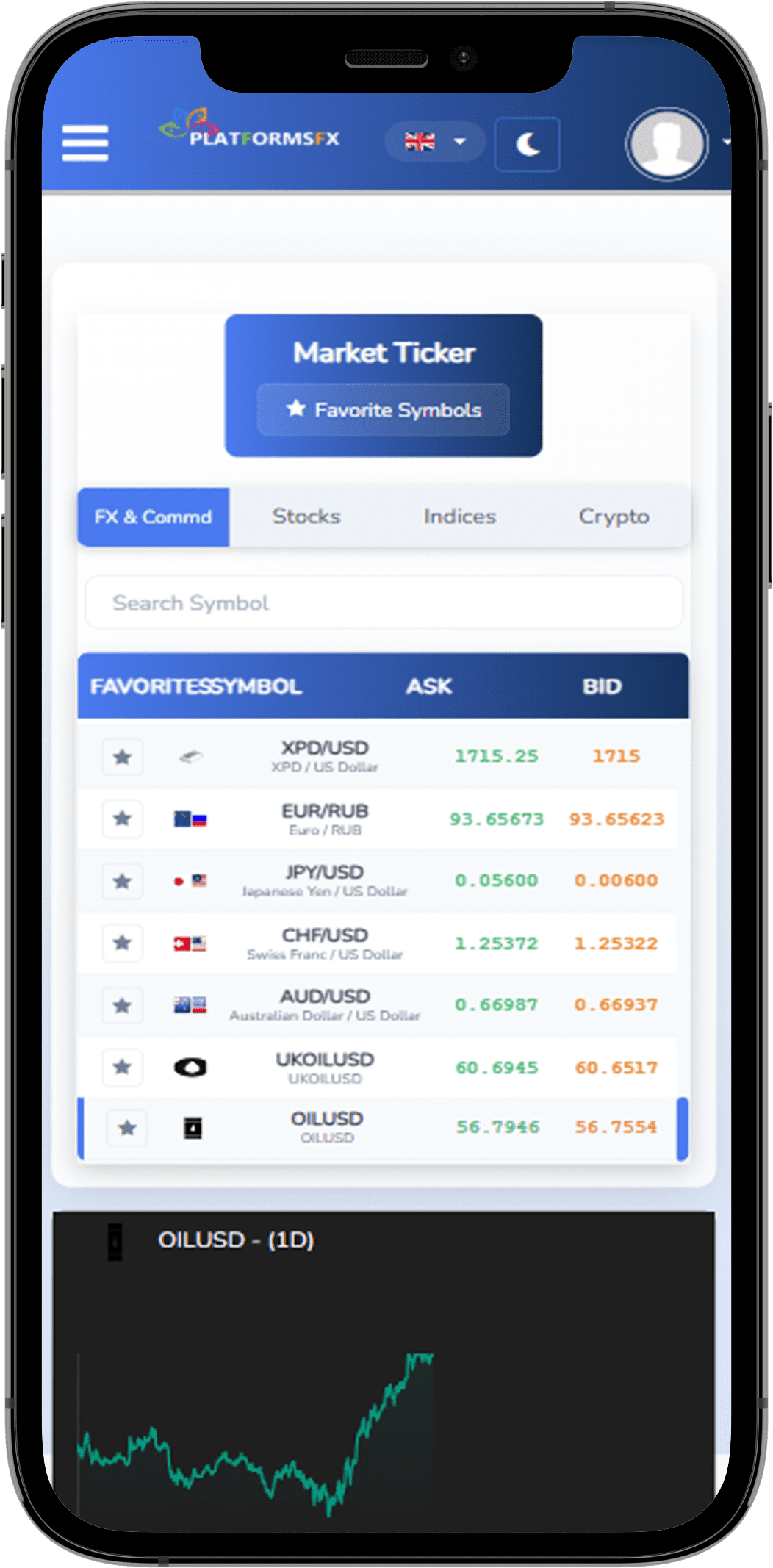

In addition to security, operational efficiency and speed in executing transactions are among the key standards of a successful trading platform. A secure platform integrated with advanced technologies enables the rapid and accurate execution of orders, which improves clients’ experiences. Clients prefer brokers who allow them to trade quickly without delays, especially in highly volatile markets.

6. Offering Advanced Analytical Tools and Robust Support Mechanisms

A secure and advanced platform includes analytical tools and effective support mechanisms that help clients make informed investment decisions. By offering tools such as technical analysis and market indicators, brokers can enhance the effectiveness of their trading platform and attract a larger segment of professional clients seeking tools to aid in successful investment.

Conclusion

A secure trading platform is not just a tool for trading financial assets; it is a critical element in the success strategy of a financial broker. Brokers focused on developing a secure and reliable platform can build a trusting relationship with their clients, achieve a competitive edge in a complex and challenging market, and foster sustained success by attracting a growing and loyal client base.