With the rapid advancements in the financial sector, technological solutions like trading platforms have become crucial for the success of financial brokers. Relying on traditional methods is no longer sufficient to keep up with the ever-changing global financial markets. Technology now provides brokers with advanced tools to enhance performance, increase efficiency, and deliver an exceptional experience to clients.

1. Speed and Accuracy in Execution

Technology plays a vital role in improving trade execution speed and minimizing human errors. Modern trading platforms can process orders within fractions of a second. This gives brokers a significant competitive edge, especially in fast-paced markets where instant responses to price fluctuations are essential.

2. Data Analysis and Smarter Decision-Making

Today’s financial markets rely on big data analytics and artificial intelligence to understand market trends and make informed decisions. Technological solutions provide advanced analytical tools that help brokers predict market movements and identify investment opportunities. They also help mitigate risks, ultimately improving profitability.

3. Security and Protection Against Cyber Threats

With the increasing risk of cyber threats, data security has become a top priority for financial brokers. Modern technological solutions offer advanced encryption systems and robust firewalls. Additionally, they provide multi-layer authentication mechanisms to safeguard client data and financial transactions from potential cyberattacks.

4. Enhanced and Integrated Client Experience

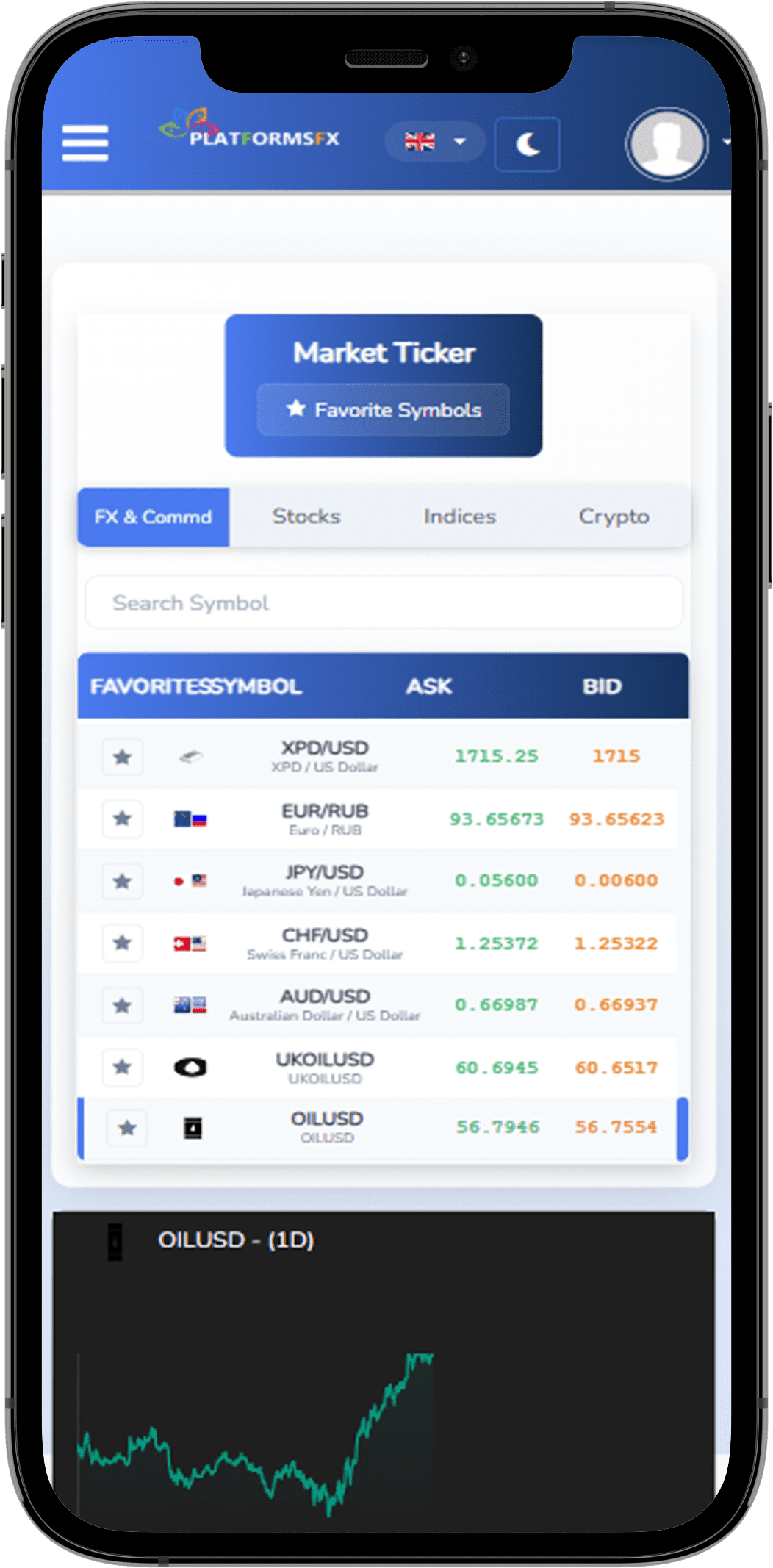

Technology directly impacts the client experience by offering modern trading platforms with user-friendly interfaces and continuous technical support. It also provides advanced features such as automated trading and customizable strategies. These enhancements strengthen broker-client relationships and increase customer loyalty and retention.

5. Regulatory Compliance and Standard Adherence

Financial markets are subject to strict regulations that require brokers to comply with specific standards. Technological solutions help automate regulatory processes, generate required reports, and ensure full compliance with local and international laws. This reduces legal and operational risks.

Conclusion

In an increasingly complex and fast-changing financial world, financial brokers can no longer ignore the importance of technology in growing their business. Investing in technological solutions is not just an option but a strategic necessity. This ensures efficiency, security, and competitiveness in a constantly evolving market. Brokers who embrace the latest technologies will be better positioned for long-term success and sustainability.