The results of the U.S. election dominated markets today after Donald Trump announced his victory in the presidential election, marking his return to the White House. Oil prices fell by more than 1% as the dollar strengthened, driven by market expectations of Trump’s victory and an increase in U.S. crude inventories beyond expectations.

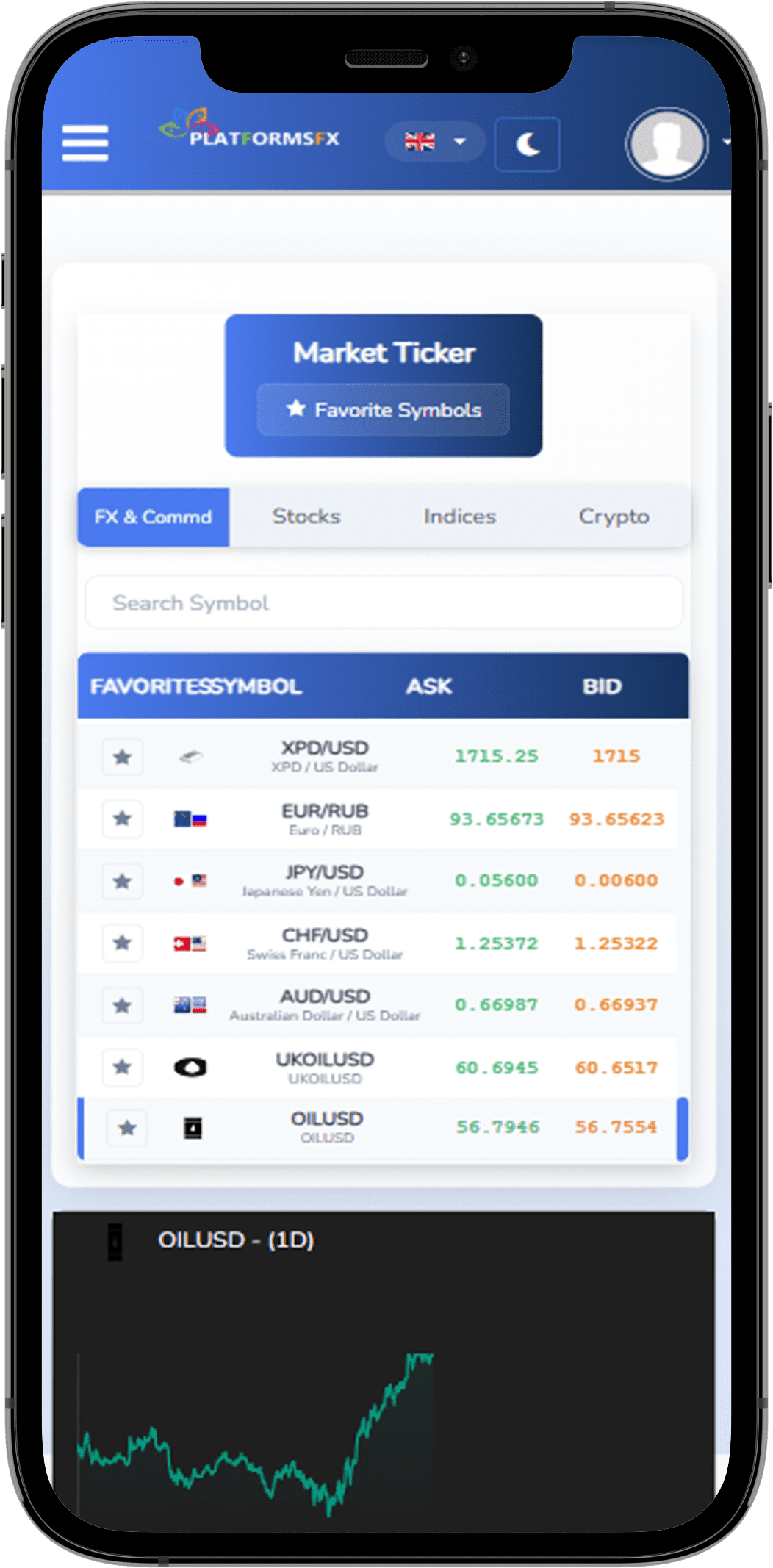

Brent crude futures declined by 1.22% to $74.61 per barrel, while U.S. West Texas Intermediate (WTI) crude dropped 1.15% to $71.17 per barrel. Tony Sycamore, an analyst at IG Markets, commented, “The early indicators lean toward the Republicans, boosting the dollar and U.S. bond yields, which in turn negatively impacts oil prices.”

In the currency market, the dollar saw its largest daily gains since March 2020, while Bitcoin surged to an all-time high as traders bet on potential support from Trump for cryptocurrencies. Bitcoin reached $75,361, a rise of 5.66%, while the dollar index rose 1.6% to 105.7, its highest level in four months.

Political developments also affected gold prices, which fell as investors scaled back their positions, awaiting the upcoming Federal Reserve meeting. Spot gold dropped 0.62% to $2,726.73 per ounce, while U.S. gold futures fell 0.54% to $2,743.90.