Introduction

The foreign exchange (Forex) market is a global financial market where

currencies are traded. It is the largest and most liquid financial market in

the world, with a daily trading volume exceeding $6 trillion. Within this vast

marketplace, a diverse array of traders engages in currency trading. Each

type of trader has its own unique characteristics, strategies, and objectives.

In this article, we will explore the most important types of traders in the

Forex market.

Retail Traders

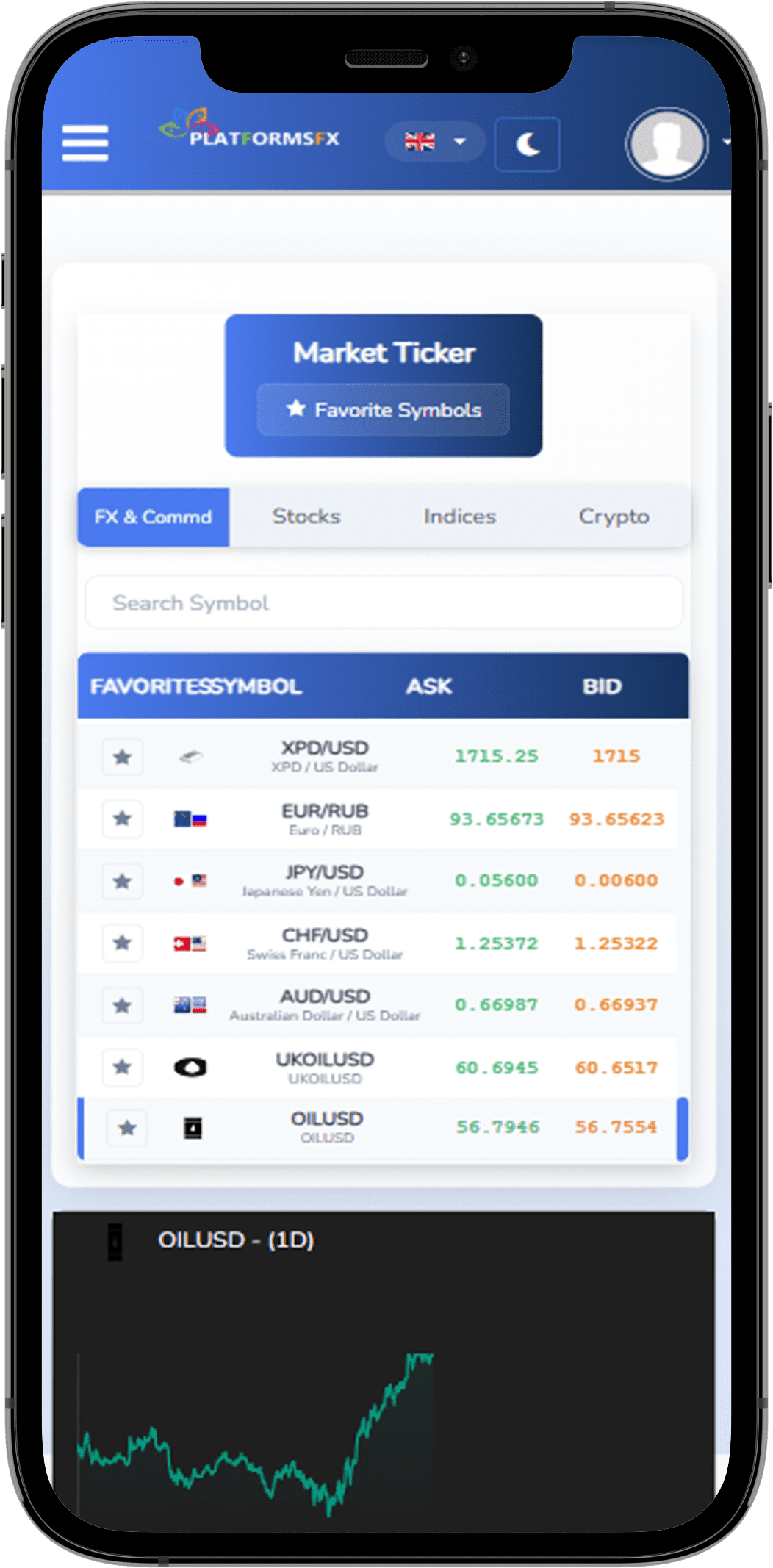

Retail traders are individual traders who participate in the Forex market for

personal investment or speculation. They trade through online platforms

provided by brokers. Retail traders often have limited capital compared to

institutional traders but can access leverage to amplify their trading power.

They engage in various trading styles, such as day trading, swing trading,

and long-term investing. Retail traders can be categorized as novices or

experienced, and they have a wide range of trading goals, from making a

supplementary income to achieving financial independence.

Institutional Traders

Institutional traders represent large financial institutions, including banks,

hedge funds, and asset management companies. These traders handle

significant volumes of currency transactions on behalf of their clients or for

proprietary trading. Institutional traders often use advanced algorithms,

high-frequency trading (HFT) strategies, and extensive research and analysis

to gain a competitive edge. They have the advantage of substantial

resources, but their trading is subject to strict regulations and oversight.

Central Banks

Central banks play a pivotal role in the Forex market. They engage in

currency trading to implement monetary policies and maintain price

stability in their respective countries. Central banks like the U.S. Federal

Reserve, the European Central Bank (ECB), and the Bank of Japan can

influence currency values through interventions, interest rate decisions, and

other policy tools. Their actions can have a profound impact on the Forex

market, making central bank traders some of the most influential

participants.

Commercial Businesses

Multinational corporations that conduct business across borders often

engage in Forex trading to manage currency risks. These businesses use the

Forex market to hedge against adverse currency movements that could

impact their profitability. For example, a U.S. company with operations in

Europe may use Forex trading to protect against fluctuations in the

EUR/USD exchange rate. Commercial traders aim to safeguard their

international revenues and expenses.

Algorithmic and High-Frequency Traders

Algorithmic traders, also known as algo traders, utilize automated trading

systems to execute a large number of orders at high speeds. They rely on

algorithms to identify trading opportunities and execute trades based on

predefined criteria. High-frequency traders (HFT) are a subset of algo

traders who place a significant number of orders in fractions of a second.

These traders leverage technology to capitalize on minor price disparities,

making quick and frequent trades.

Carry Traders

Carry traders focus on profiting from the interest rate differentials between

two currencies. They borrow money in a currency with a low-interest rate

and invest it in a currency with a higher interest rate, earning the difference

as profit. The success of carry trading depends on the interest rate

differentials, currency stability, and economic conditions of the countries

involved.

Conclusion

The Forex market accommodates a diverse range of traders, each with

unique objectives, strategies, and resources. From retail traders looking to

build personal wealth to central banks shaping national economies, the

Forex market is a dynamic and multifaceted arena. Understanding the

various types of traders is crucial for anyone looking to enter this complex

and exciting world of currency trading. Whether you’re an individual

investor, a financial institution, or a central bank, the Forex market offers

ample opportunities for participants to achieve their financial goals.